The bursting of the American housing bubble of 2007-2008, and the bank bailout and foreclosure crisis that followed, is one of the biggest boondoggles in U.S. history. The only reason why people weren’t more incensed about what happened, and the broken and twisted system that allowed things to play out as they did, is that it was so complicated that most people never quite understood what was going on. Here’s my understanding: a combination of factors, including growing wealth in countries like China, policies in the U.S. to encourage middle-class home ownership, and de-regulation of the banking and insurance industries led to the creation of complicated securities packages that allowed investors to invest in packages of subprime mortgages.

This led mortgage companies to offer loans to riskier and riskier prospects, to the extent that people didn’t have to even prove how much money they made. In other words, you didn’t even have to prove that you could pay the mortgage back in order to borrow hundreds of thousands of dollars to buy a house. Many borrowers were given adjustable interest mortgages that started off with a low interest rate and then raised sharply in 3-5 years. This meant that your monthly house payment could double or triple in just a few years. The idea was that by the time your balloon payment kicked in, your house would be worth twice as much and you’d be able to either refinance or sell the house, and thus wouldn’t have to worry about higher mortgage payment. This was combined with aggressive campaigns by lenders to have people take out second and third mortgages on their homes. The logic was that the housing market was rising so sharply that your house would be worth much more in a few years so you’d easily be able to pay off your second mortgage.

Everything was fine so long as housing prices continued to grow. The problem was that eventually they got so high that there was no one willing to buy them for a higher price, and it became obvious that people couldn’t afford their payments. Housing prices in towns like Stockton and Salinas California got stupidly high: $600,000 for a home in an area where you’d be lucky if you could make $50,000 a year. Balloon payments kicked in and people couldn’t sell or refinance their homes, so they suddenly found themselves unable to pay their mortgage. Banks fell apart. The companies that insured the securities fell apart. For a few days in 2008 there was a real fear that the entire U.S. economy would collapse. So congress jumped into action, passing multiple bailouts and stimulus packages that shored up most of the lenders. And this is where the average American got totally screwed. The banks, flush with government money, stopped lending, which further damaged the economy. Many of the executives who helped drive the country into ruin still got lavish bonuses, at the same time millions of Americans were getting laid off. Instead of working with homeowners to refinance their homes, banks foreclosed on millions of people. They did this en masse, using third party “robo-signers,” giving homeowners little opportunity to challenge their foreclosures.

Some argue that people need to take responsibility for their debts, and that the blame for the crisis is on people who bought more house than they could afford, or took out second mortgages so they could buy stuff. There is truth to that, only it ignores just how aggressively these mortgages and second mortgages were marketed, and how complicated and confusing buying a home is. I know many people who lost their homes in the crisis, and none of them were greedy or stupid. They were just going along with what everyone was telling them was the right thing to do. Anyone who already owned a home got several calls a week asking them to take out a second mortgage. All this was happening around the same time that shopping became America’s patriotic duty. In the wake of September 11, signs with the American flag as a shopping bag and the slogan “America: Open for Business” appeared everywhere. We were no longer citizens, we were consumers, and the entire economy was built upon us taking on more debt to be able to buy more and more stuff. And when it all fell apart, the architects of the system made money and got golden parachutes, while the average American was laid off and kicked out of their home.

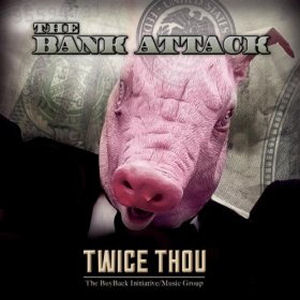

The housing crisis and bailout might not seem like the most obvious thing to make a rap record about, but Boston rapper Twice Thou has done just that. It’s not a totally crazy idea. For one thing, there’s a lot of material to cover, enough for a 28-track album in fact. For another thing, the bankers involved in the subprime mortgage mess are just as shiesty and crooked as the crack dealers and gangsters that are the subject of many rap songs. Both have devastated families and neighborhoods with their business practices, only the bankers made more money and never had to worry about going to prison, much less getting shot.

Twice Thou is in a good place to rap about the housing crisis. He knows first hand how shady many of the foreclosures are, and how quick the banks have been to screw homeowners dealing with inflated mortgages, ballooning payments, and unemployment. He was affected by it directly when he found himself underwater on his home and unable to pay his mortgage. When Bank of America sicced a robo-caller on him to foreclose on his house, they soon found out that Twice Thou was the wrong dude to mess with. He got hooked up with City Life, a nonprofit that helps protect homeowners, and got involved in their struggle. He’s now an organizer for City Life, reaching out to homeowners facing foreclosure to help them fight the system. He describes their process in “H.E.L.P. (Heal the Economy Lower Principle)”:

“Harvard Lawyers, The SHIELD is our legal defense

Big Banks stole our money, Glass-Steagall offense

The SWORD is the public pressure and the protests

Principal Reduction, we’re settlin’ for no less

The OFFER is the buyback, by a non-profit

At real current market

Casework, political discussions

It’s high tide, criminal repercussions”

Twice Thou also knows the rap game. He’s an OG MC, first introduced as E-Devious as part of 90s crew the Almighty RSO. Later that decade he hooked up with Benzino as part of the Made Men, which perhaps isn’t the most illustrious part of his career. He also branched out into fashion: his Antonio Ansaldi label was responsible for all those “Stop Snitching” clothes. His current campaign to help underwater homeowners seems like a better use of his time and talents.

“The Bank Attack” is equal parts activist rap and street rap. Twice Thou’s years in RSO and Made Men gave him a 90s East Coast gangsta delivery, and his years working for City Life have given him a deep knowledge of the housing crisis. As a result, the songs are full of lyrics that outline the crisis in expert detail, often with a gangsta spin. “Hush Money” lists the bonuses that banking CEOs got, by name:

“It’s the biggest ponzi, more than 7 trillion

Charged back to the workin’ civilian

We foot the bill, when they roll them dice

While they use our money, to control our life

You ain’t gotta dumb it down, just smarten up

If we don’t, they’ll continue to target us

They couldn’t come up with a ‘Fall Guy’

They had to decide, how to keep everybody all quiet

Guess what’s next?, they cut checks

Compensation, gag-orders, nuff said

Lehman Brothers, before it collapsed

183 Million, fell in their laps

Goldman Sachs, received a waiver

And a 814 Billion dollar disclaimer

Douglas Morgan, the Citibank Chief

Reaped 21 Billion, to turn the other cheek

And get his hush money”

“Bankersville, U.S.A,” paints the bankers as gangsters. The lyrics are all reprinted at thebankattack.org, and Twice Thou highlights the names of the banks and bankers he is calling out:

“Once upon a time in .. ‘BANKERSVILLE, USA: LAND of SWAPPORTUNITY’

They caused a housing crisis in the community

Sellin’ bad loans like bundles of dope

They called it ‘Suicide Mortgage’, oughta come with a rope

In HUDSON CITY, there was five FORECLOSURE GANGS

The most ruthless one was BRIAN MOYNIHAN’s

Home after 8 years in WASHINGTON FEDERAL

Lookin’ for his old flame, CATHAY GENERAL

But word on the street, she been sleepin’ with the enemy

Had a daughter with JAIME DIMON and named her EQUITY

JAMES GORMAN, put the faire in savoir

Drove an almond colored, armored FLAGSTAR jaguar

Latin assassin by the name of WESBANCO

Hostage negotiators, BANKWEST condo

He had a bulletproof reputation

Teflon, ‘MANDATORY MEDIATION'”

Almost all message music has at least some trouble reconciling the message with the music, and “The Bank Attack” is no exception. Twice Thou is a skilled MC, which allows him to translate his message into rhymes better than most. Still, there are some clunky moments where he has trouble translating his activism into hip-hop form, which is perhaps inevitable given how complex the subject matter is. Those clunky moments are relatively few and far between, owing to Twice Thou’s expertise as both a rapper and activist. He knows what he needs to say and the best way to deliver it in a song.

From what I can tell, Twice Thou handles the production as well. The beats have a late-nineties East Coast feel. The drums are thumping and slightly plodding, with samples adding hints of melody. There are also some tracks, like “Free” and “Worst Kept Rumor,” that give a nod to West Coast G-Funk. Album closer “Movement Ready” adds reggae to the mix. For the most part the beats are fine, if not spectacular. They work when paired with the lyrics, but they wouldn’t necessarily stand on their own or with less worthy subject matter.

From a purely musical perspective, “The Bank Attack” is decent but not amazing. If Twice Thou was rapping about the same ol’ same ol’, the album wouldn’t stand apart from the deluge of other material out there. As a piece of hip-hop activism, however, “The Bank Attack” is incredible. Twice Thou knows the subject matter backwards and forwards, and does an admirable job of making his activist message work as raps. Even more admirable is how focused, coherent, and organized this album is. He’s using “The Bank Attack” to get City Life’s message out and help educate underwater homeowners about their rights. He manages to get this mission across and make convincing rap music in the process. There aren’t that many artists making protest music, and most of that falls along the lines of “screw the system!” To hear an artist who is not only making protest music against the big banks, but using his music as a tool to help people keep their homes is impressive and deserves praise.

At the end of “The Bank Account,” Twice Thou takes ten minutes to thank those involved in the album. First he thanks the usual types of people you hear thanked on a rap album: God, his mother, his wife, his fellow rappers, his daughters. Then he goes on to thank all of the community groups who are helping to fight back against foreclosures, spelling out all of the acronyms of the groups and giving shout outs to individual activists. it’s the first time I’ve ever heard that on an album. I mention it because it’s another example of how committed Twice Thou is to his activism, and how unique “The Bank Attack” is as a piece of protest music and activism.